Trading Platforms

For more than thirty years, CQG, Inc. has been the industry leader for fast, accurate, and reliable market data and unrivaled graphical analysis. Today, CQG provides high-performance trade routing, global market data, and advanced technical analysis. CQG’s market data feed consolidates more than seventy-five sources, including exchanges worldwide for futures, options, fixed income, foreign exchange, and equities as well as data on debt securities, industry reports, and financial indices.

Sweet Futures would like you to take advantage of a Free Online Trading Demo. Don’t just choose any online trading platform; Choose the platform that’s right for you. From the novice to the advanced trader, CQG has many online trading platforms to fit your trading needs. Sweet Futures will help you find a trading platform that meets your trading needs.

CQG offers the following innovative products with speed and support traders rely on:

CQG Integrated Client

CQG Integrated Client earned a solid reputation through decades of reliable performance, providing traders with innovative trading interfaces complete with accurate global market data, professional analytical tools, and advanced order routing. Access all this in one powerful application: CQG Integrated Client.

CQG QTrader

CQG QTrader offers powerful trading tools and technical analysis features to trade and monitor the markets. It combines analytics, charts, and multiple trade execution interfaces in one comprehensive solution for professional traders. Electronic trading connectivity is available to more than forty global exchanges.

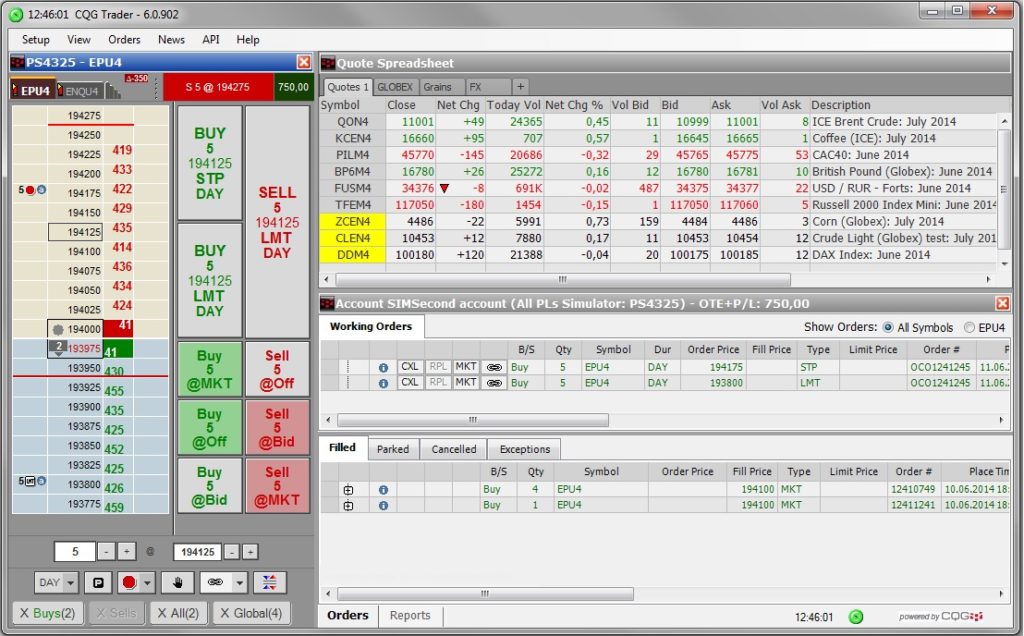

CQG Trader

CQG Trader is a high-performance market data and electronic trading application for traders who do not require technical analysis tools. It provides Order Ticket or DOMTrader, Quote Board, Orders and Reports window, and CQG News. Electronic trading connectivity is available to more than forty global exchanges.

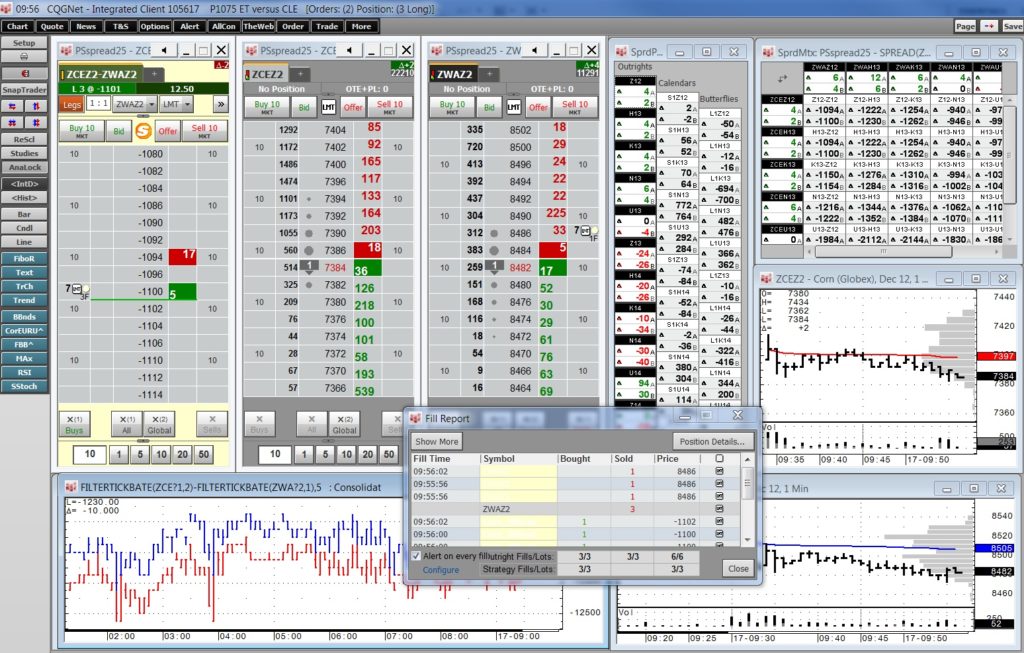

CQG Spreader

CQG Spreader provides sophisticated order management and ultra-low-latency trade execution. It allows traders to easily create, trade, and manage multi-legged, Intermarket, and Intramarket spreads across accounts and asset classes. The proximity of the CQG Spreader Core, co-located servers at the exchanges, to the exchange servers allows modification and execution of second legs to occur in less than one millisecond.

CQG M

CQG M is a mobile product for on-the-go access to quotes, analytics, and trading. This HTML5-based mobile app delivers market data, order management, and electronic trading on iPhone and Android phones, tablets, PCs, and Macs. Built on CQG’s robust cloud infrastructure, CQG M has all of the data quality, coverage, and reliability that global traders have come to expect. Now anywhere, anytime.

CQG APIs

CQG Client APIs include solutions for customers needing the most reliable data, advanced analytics, and ultra-low-latency trading. The CQG Data API makes it possible to seamlessly deliver CQG’s market data and analytics to external applications. The CQG Trading API grants access to the CQG Hosted Exchange Gateways for order routing from external applications.

CQG Data Factory

CQG Data Factory provides decades of historical data for purchase online. Order and download accurate data from over sixty exchanges worldwide. CQG Data Factory offers traders more than twenty years of end-of-day market data and more than seven years of intraday data, including time & sales, intraday bar, and trade volume. Customers can also access additional data from as far back as the 1930s.

Electronic Trade Routing

- Electronic trading connectivity to more than forty exchanges

- High-speed network of distributed exchange gateways

- Partnerships with over one hundred FCM environments

- Depth-of-market views on price ladders and trading directly from the charts and quote pages

- Comprehensive pre-trade risk management

Order Routing Tools

- Multi-legged, intermarket, intramarket, and exchange-traded spreads can be created, traded, and managed (CQG Spreader) Orders for outrights and spreads based on yields

- Two depth-of-market order book views of the electronic exchanges (DOMTrader® and Order Ticket)

- A trade routing application that can be attached to any CQG application, such as a quote board or chart (Order Desk) CQG’s server-side order routing gateways manage where you get filled when you trade similar instruments on two or more exchanges (aggregation)

- Charts include a trade routing tool and order management window (SnapTrader® with the Order Book)

- Spreadsheet trading with over two hundred market data elements available, including order routing (Spreadsheet Trader)

- Synthetic and exchange-traded spreads can be monitored and traded from two customizable, matrix-style quote displays (Spread Matrix and Spread Pyramid)

- CQG and custom study values and condition alerts can be displayed on the DOMTrader

Automated Execution

- CQG AutoTrader is a proprietary trading execution engine that allows customers to

simultaneously execute numerous systems at once with equal precision and discipline. - For maximum transparency, CQG AutoTrader is integrated with various position monitoring

modules, such as the Orders and Positions window and the Automated Trading System (ATS)

study, where customers can monitor trading signals and positions on charts and trading

interfaces.

CQG Smart Orders

CQG supports both exchange-supported and synthetic orders. Each smart order has unique features designed to aid the trader in better order and trade management. Smart orders include:

- DOM-triggered stop/stop limit

- Trailing limit

- Trailing stop/stop limit

- Bracket

- Order-cancels-order

- Study-following order

- Condition following order

- Alert trading

- Funari

- Algorithmic orders, including iceberg and offset stop limit

News

- Computer-readable news: key US, Canadian, and European economic releases

- Comprehensive Dow Jones Newswires, FastMarkets News, The Hightower Report, MarketG2 News, Market News International, and Need to Know News

- Innovative display

- Powerful search and filtering features

- Dynamic design supporting secure delivery of proprietary customer feeds

Consolidated Market Data

- High-speed, real-time, and historic market data from over seventy-five global sources

- Foreign exchange, fixed income, energy, derivatives, equities, single stock futures, and OTC markets

- Different styles of quote displays

- Cost-effective, scalable market data management and delivery

- Dedicated data quality staff in five locations across the globe covering the US, Europe, and Asia

- Sophisticated symbol search

Decision-Making Tools

- State-of-the-art charting and analytics

- Numerous chart styles, including CQG’s exclusive TFlow®

- Portfolio and Instrument Monitors

- Exclusive tools designed for today’s electronic markets

- Over one hundred basic and custom studies

- Custom formula builder

- Various types of alerts

- Robust trade system design and backtesting features

- Advanced options strategies analytics

CQG QTrader includes advanced analytics, charts, and multiple trade execution interfaces in one comprehensive solution for professional traders.

- Spreadsheet Trader: Customizable spreadsheet-based trading application that allows traders to track the state of an extensive collection of markets using their favorite studies, conditions, and alerts.

- Order Ticket: Integrated depth-of-market and order management interface that minimizes the use of screen real estate.

- DOMTrader®: Professional order-entry application that provides market transparency.

- Order Desk: Comprehensive desk-trader tool that attaches to any application, such as a quote board or a chart.

- SnapTrader®: Innovative interface designed to provide one-click trading functionality and increase screen space.

- Server-Side Aggregation: Automated and ultra-low-latency management of orders in aggregated markets.

- Alert Trading: Notifications of when a particular price, time, study, or trend-line condition has been met.

- Spread Matrix and Spread Pyramid: Powerful trading applications that allow traders to define and monitor both synthetic and exchange-traded spreads and trade exchange-traded spreads.

Orders and Positions

Monitor and manage futures accounts using real-time prices with Orders and Positions. The Trading Summary shows all daily trading activity by account or across all accounts. Account information can be exported to a Microsoft Excel® spreadsheet or as an HTML file.

Charting and Analytics

- Bar: Bar charts display classic open, high, low, and close values.

- Candlestick: Candlestick is a price pattern recognition technique based on one-, two-, or three-line patterns.

- Line: Line charts connect closing prices.

- TFlow® and Time-Based TFlow: TFlow bars are color-coded to show a percentage of executed volume at the best bid and best ask prices. Time-Based TFlow charts use features similar to CQG’s TFlow bars except the bars are based on time.

Studies

Access a host of analytic tools, including the popular Bollinger Bands, Moving Average Convergence/Divergence (MACD), and Average True Range (ATR) studies.

Instrument Monitor

Monitor the state of multiple conditions and study values for multiple chart types and intervals. The Instrument Monitor makes it possible to view real-time market data and study values and view the status of conditions for an instrument in a single, comprehensive view. It enables a technical view of the markets using multiple time frames and chart types for a single instrument.

RealTimeData (RTD)

Deliver market data and other information to Excel using CQG QTrader’s RTD feature. Drive calculation formulas based on cells that reference real-time data. Request market data, historical data, and current working orders and positions data.

CQG Trader is the perfect execution platform for traders who do not require technical analysis tools. CQG Trader offers real-time quotes, trading, and order management.

Customizable Trading Applications

- DOMTrader®: Provides market transparency and intermarket and multi-market trading.

- Order Ticket: Includes buy and sell buttons and enhanced visibility of the net change and volume.

- Quote Board: Displays the open, high, low, and close values.

CQG News

- Displays headlines with varying font sizes, highlighting the most current news releases.

- Keyword search allows traders to browse news releases based on their trading needs.

- Traders can adjust CQG News preferences to display the story pane, timeline, and recent headlines in scroll mode; to improve color schemes, and to highlight keyword searches.

- Available services include Dow Jones Newswires, FastMarkets News, The Hightower Report, MarketG2 News, Market News International, and Need to Know News

Additional Features

- The platform can be white-labeled to establish your brand further.

- Customers interested in FX can trade non-even amounts of currency and efficiently manage orders and positions using large-quantity abbreviations.

- DOM ladder compression is available for thinly-traded electronic markets.

- Fills executed outside the CQG Hosted Exchange Gateways, such as pit trades, can be entered in the Orders and Reports window.

- Net open trade equity for related futures and options positions can be displayed.

- Non-English speakers can take advantage of using the application in different languages.

The CQG Spreader Core (our co-located servers at the exchanges) uses proprietary algorithms to manage working legs of the spread. Bid/Ask queues per leg in the exchange’s order book are monitored by the spread servers for liquidity. The close proximity of the CQG Spreader Core to the exchange servers allows order modifications and execution of second legs to occur in less than a millisecond, which means premium placement in the order queues for your working legs.With the CQG Spreader Core, you don’t have the up-front cost associated with a black box solution for low latency. CQG maintains the hardware and manages the exchange relationships.

The Spreader Core eliminates geographic latency for traders in any location. Our global network of trading gateways provides access to major exchanges, such as CME Group, Liffe, ELX Futures, Eurex, and Intercontinental Exchange, offering a superior advantage for trading inter-exchange spreads.

For fixed income and futures cash spread trading, CQG Spreader allows you to route orders and connect to BrokerTec, BGC, CME Group, ELX Futures, GovEx, and NYSE Liffe U.S.

Functionality

- Set up spreads with up to forty legs and actively quote up to ten legs.

- Configure leg ratios, scale, order management, and legging risk.

- Prioritize leg placement.

- Easily identify spreads and their legs with DOMTrader® and order color-coding.

- Manage spread trading across accounts.

- Set up monitored leg orders using bid and ask queue volume conditions.

- Manage risk with overfill management.

- Trade ratio spreads with proportional execution.

- Manage placement with queue holders.

- Trade off net change prices or yield.

- Manage incomplete orders with a pay-up limit or with CQG’s smart trailing limit orders.

- Use Sniper Mode for near-instantaneous execution and to reduce message counts.

- Use QFormulas to simplify complex strategies.

- Access CQG’s full suite of charting and analytics tools.

- Incorporate computer-readable news events into your spread trading strategies.

- Monitor and manage spread activity with Spread Matrix and Spread Pyramid.

CQG M is an HTML5-based mobile app that delivers advanced market data, order management, and electronic trading on phones, tablets, PCs, and Macs. CQG M allows traders to see advanced market data and execute orders on the go. Built on CQG’s robust cloud infrastructure, CQG M has all the data quality, coverage, and reliability that global traders have come to expect. Now anywhere, anytime.

Benefits

- CQG’s robust cloud infrastructure has been the industry standard for data quality in the futures industry since 1984.

- CQG M works on virtually any platform and uses the latest technologies to bring a robust experience: HTML5, protobuf, and websocket.

- CQG M’s feature set is focused on the functionality that traders really need in a mobile app.

- Global market data coverage and trade execution is delivered via CQG’s infrastructure.

Features

- Highly customizable interface

- Mobile market data coverage, including futures and FX with several quote board styles

- Futures and FX trading with support for basic order types, GTC, and GTD

- Orders and Positions views for managing orders

- Charting tools and analytical studies

- Account summary overview to see OTE, P/L, and margin

- Compatibility

Mobile Devices

- Android smartphones and tablets

- Apple iPad 2, iPad generations 3 and 4, and iPad Air

- Apple iPhone 4S, iPhone 5, iPhone 5C, iPhone 5S, and iPhone 6/6+

Operating Systems

- Android v4.1.2 and later

- iOS7

- OS X Mountain Lion and later

- Windows 7 and later

CQG provides the ability to bring real-time market, study, and orders and positions data into Microsoft Excel®. In addition, CQG offers two Excel add-in tool-kits. Once installed, these add-ins appear on the Excel ribbon.

CQG – Powered Spreadsheets

Partner CQG with Excel to build dashboards using real-time market data and studies from CQG via RTD syntax within Excel.

CQG Toolkit for Excel (32-Bit)

The CQG Toolkit pulls today’s market and orders and positions data via the Internet into Excel. Historical data is not available. CQG products do not need to be running. This toolkit does require you to have an account with a CQG FCM partner as this is an FCM enablement. The toolkit accesses market and orders and positions information using the exchanges you are enabled to trade by your FCM.

Features

- Excel function-like syntax

- Cell references that are part of the formula

- Far more orders and positions data compared to RTD Toolkit is available, including fill prices

- Today’s market (label) data

- Depth-of-market data

- Account data

- Account summary

- Orders data including fill prices

- Open positions data

The market and orders and positions data is limited to 200 symbols.

CQG RTD Toolkit for Excel (32 & 64-Bit)

CQG supports the RealTimeData (RTD) function for delivering market data and other information to Excel. Through the combination of CQG and Excel, you can create highly customized applications designed for your specific needs.

The CQG RTD Toolkit uses Microsoft’s RTD Worksheet function to pull real-time market data and other information from CQG Integrated Client, CQG QTrader, and CQG Trader (only a limited amount of market data is available from CQG Trader).

Features

- Excel function-like syntax

- Cell references that are part of the formula

- Twenty thousand unique topics, which can be updated three times per second and one topic can be updated 200 times per second

- Twenty thousand cells for market data, 5,000 cells for historical and study data, and 500 combinations of order-related data that are supported by CQG

These limitations relate only to RTD technology, not data limitations; historical data is limited to 300 daily/weekly/monthly bars and 300 days of intraday data.