Trading Platforms

Patsystems delivers tailored solutions, built from modular components, to enhance derivatives trading performance and trade processing. There solutions include real-time risk management tools, comprehensive exchange systems and robust trading systems with extensive market connectivity. Patsystems offers a choice of two industry-leading futures and options trading platforms with advanced functionality. Pro-Mark and J-Trader are Patsystems 2 proprietary front-end trading platforms. The world’s leading banks, trading houses, hedge funds and professional traders rely on Patsystems technology for electronic trading in derivatives.

Sweet Futures would like you to take advantage of a Free Online Trading Demo. Don’t just choose any online trading platform. Choose the platform that’s right for you. CME Direct is a highly-configurable trading front end for CME Group markets. Access CME Group electronic futures, options and Block markets – all on one screen. Choose the best way to execute trades either online or through a voice broker.

Patsystems offers a host of solutions to meet your trading needs:

Pro-Mark

Pro-Mark is an advanced futures trading application designed for professional, high-speed, high-volume traders. Key features include:

- Multi-leg auto spreading

- Excel integration

- Options strategy creation

- Broker functionality

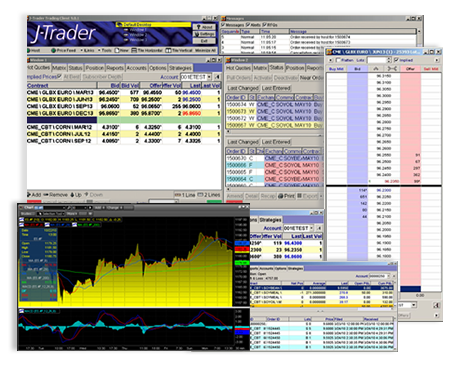

J-Trader

J-Trader is the ideal all-purpose futures trading tool. This popular front-end is versatile and easy to use. Key features include:

- Single click trading, cancelling and amending

- Real-time profit and loss

- Protection of orders with Trailing Stops and Bracket Orders

- Single and multiple account trading

- Advanced functionality, such as multi-exchange spreading and one-click scalping

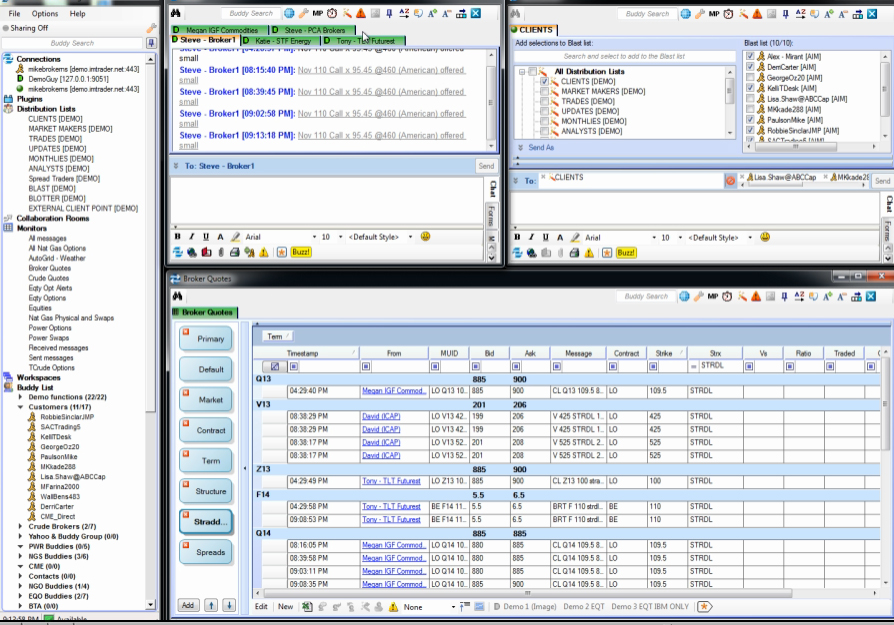

IQ-Trader

Designed for technical and system traders, hedge fund managers, commodity trading advisors and other advanced users, IQ-Trader is an excellent tool for professionals who want a comprehensive view of markets and products.

IQ-Trader enables you to perform sophisticated operations without the need for programming skills. Intelligence is in-built, intuitive, automatic.

Risk Management

From the pre-trade risk management module within our trading system to our standalone real-time risk management tool, Patsystems has emerged as a leader in risk management solutions.

Whether you represent an investment bank, FCM or proprietary trading firm, Patsystems risk solutions can be tailored to meet your business requirements and manage your risk exposure.

Pre-Trade Risk Management

System And Risk Administration (SARA) is the pre-trade risk management module within Patsystems trading environment. SARA ensures that traders operate according to parameters specified by their risk administrators, who in turn, are able to access all the information required to maintain control of the trading community they are responsible for managing.

Post-Trade Risk Management

Risk Informer is a standalone, platform independent risk management system that calculates initial margin and P&L in real-time. Risk Informer can be used to manage risk for multiple asset classes including futures and options, FX, equities and CFDs.

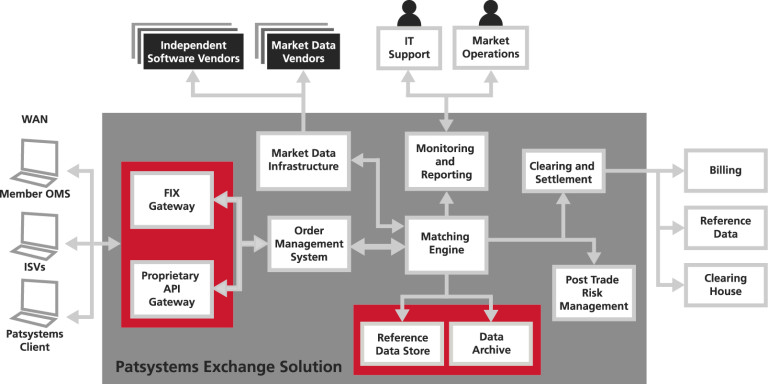

Exchange Solutions

Patsystems provides complete end-to-end exchange technology built around the Patsystems Matching Engine. Our exchange technology can be used as a standalone system, or combined with our front-end trading system and post-trade risk system to create one fully integrated front-to-back office solution.

Patsystems Matching Engine

A matching, clearing and settlement system, the PME was acquired from Exchange Network Systems in 2000 and is currently used by seven exchanges including the Indonesian Commodity & Derivatives Exchange (ICDX), Mercado a Término de Buenos Airea (MATba) and the Turkish Derivatives Exchange (TurkDEX).

J-Clear

J-Clear is an event-based processing module that enhances the Patsystems trading platform. Put simply, it is a tool that initiates specific processes in response to particular events or scenarios, facilitating real-time fill processing. J-Clear enables straight-through processing of trades executed via the Patsystems platform.

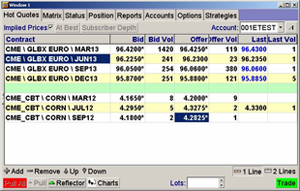

Reflector (Depth of Market)

- A unique depth of market screen with single-click trading, cancelling and amending

- Dynamic prices, price and order locking, dime features, last-traded price, inside market, day high/low, book weighting

- Colour-coded indicators to help you see spread patterns and identify breakout, support and resistance levels

- Smart, multi-order amendment (amend multiple orders at the same level, using either a pro rata or ‘last in/first out’ function)

Live Quotes Screen

- See any contract, anywhere, with full details

- Trade initiators – customize your screen, creating the steps to suit your trading profile and enhance manoeuvrability and precision

- Optional embedded tickets

- Strategy control – see strategy depth, each leg of the strategy, and the depth of each leg

- Quick order finding

- Floating trading tools linked to each Live Quotes screen

- Simple tab system for quick location of contracts by exchange

Options Trading Screen

- Call and put options centralized around the ATM strike

- Multiple contract tabs

- Easy expiry navigation

- Embedded option trade ticket

- Strategy creation and look-up tool

- Options screen links directly to strategy creator for single click strategy creation

Strategy Manager

- Create advanced, customized strategies using Patsystems Strategy Manager

- Supports User-Defined Spreads such as Iron Condors, Butterflies, Strangles and Straddles

- Strategies can be traded in Patsystems multi-leg spreading tool, Prism, with up to 16 spread legs

Prism Multi-leg Auto Spreading

- Intelligent ‘next generation’ multi-leg spreading

- ‘Deductive logic’ to help you place orders at the best price to execute a strategy

- Create any strategy, in any ratio, across any number of legs

- High level of protection against underfills and overfills

- Work two legs in the market, combine futures and options, expand legs to any asset class

- Work ‘stops’ in strategies

- Work the available volume using the Volume Tracker

- Message Tracker tool enables you to monitor messages to exchanges

Excel Integration

- The flexibility of Excel and the power of Pro-Mark are seamlessly integrated, allowing you to customise and execute any number of trading strategies

- Integrated order entry, amendment, cancellation and positions

- Real-time data feed (RTD) Bulk order entry directly into Excel from order book

Reflector (Depth of Market)

- A unique depth of market screen with single-click trading, cancelling and amending

- Dynamic prices, price and order locking, dime features, last-traded price, inside market, day high/low, book weighting

- Colour-coded indicators to help you see spread patterns and identify breakout, support and resistance levels

- Smart, multi-order amendment (amend multiple orders at the same level, using either a pro rata or ‘last in/first out’ function)

Hot Quote Screen

- User-defined trading window

- Single/double-click tradingJ-Trader_2

- View and trade all main markets

- Graphically interfaced market depth and last traded prices

- View implied prices

- Automatic execution and pricing of user-defined MEL strategies

- Tradable depth of market

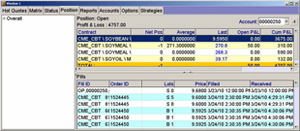

Real-Time Position Display

- Real-time P & L

- Real-time position management

- Full trade history

- Commission deducted automatically from P & L.

- View P & L and positions for many accounts, in real-time from the same window.

Options

- Call and put options centralized around the ATM strike

- Easy expiry navigation

- Basic strategy creation

Charting and News

- An integrated charting window with streaming, real-time data

- More than 30 technical studies with user-changeable parameters

- Fully customizable trendlines, colors, chart types and more

- News window that offers comprehensive real-time news, including commodities news and the ability to view full stories or just headlines

- Charting and news window powered by Market-Q.

Tactics

- Instantly modify orders and assign a pre-defined Tactic with a single click

- Turn a static stop into a trailing stop

- Secure your profit at break even

- Move an entry order one tick ahead of the market

Live Quotes

- Drag-and-drop trading window for pricing, order entry and cancellation

- Position and P&L display in quotes window

- Tabbed working order/completed order display

- Ladder-style depth of market order entry including volume at price display and market weight indicators

- Bracket orders to automate exit and stop loss

- Open positions are s saved by the IQ TradeGuard

Multiple Time Frames

- View multiple time frames in one chart

- Trade and modify orders in every time frame

Speed-Trader

- Streaming prices

- Depth of Market

- One-click trading

- Order display and volume histograms

Multi-Leg Spreading

- Cross-product and cross-market spreading with any number of legs

- Active quoting of one or more legs in the market

- Enables spread of spreads

- Charting of spreads with historical and intra-day views

- Create trading signals on spreads for automated trading

- Position management and brackets on spreads

Real-time risk management software

Risk Informer is Patsystems’ standalone, multi-asset class post-trade risk management software.

Risk Informer provides a real-time risk view across all your trading activities and systems. It lets you calculate margin requirements in real-time, and manage risk for products such as exchange-traded derivatives, equities, FX and CFDs using standard margin methodologies including CME SPAN® & TIMS. It aggregates trades on a real-time basis from exchanges and in-house feeds, and it re-calculates margin requirements and other risk metrics.

Flexible and configurable limits give you total control over all of your business. Limits can be set at any level of account, by exchange, product, sector, or any combination of attributes. When you receive a limit alert, drill down through positions to see a complete view, and slice and dice client exposure by a wide range of criteria.

Key benefits of Risk Informer include:

- Consolidated view of traders’ cross-product positions in real time

- Total transparency – drill down to any level of granularity

- Focus on hidden portfolio exposures to target more effective hedging strategies

- Profit and loss/risk factors clearly explained

- Track exposure in market and credit-based risk positions

- Stress-testing and simulations with actual portfolio position and validated models

- Early identification of hedge mismatching, strategic trading and arbitrage opportunities

- What-if scenarios, including trades, pricing models and input data

- Alerts-based notification of credit line and counterparty limit breaches

Patsystems exchange solution key elements:

- Internet-deployable front-ends

- Order management

- Risk management

- Order routing

- Order matching

- Member clearing

- Trade registration

- Multi-level back-office reports

Comprehensive project management:

- Pre-installation: requirements definition study, business planning, customised development

- Installation: integration, configuration and testing, licensing, disaster recovery planning, integrated delivery management

- On-going support: 24-hour support and maintenance, global help desk, system and application training, account management

The matching engine allows Patsystems’ customers to provide their clients with proprietary marketplaces in products such as commodities and foreign exchange. This enables brokers and clearers to combine proprietary markets with regulated markets, creating products that are client-specific. This is particularly valuable in eastern Europe and the Asia-Pacific region, where there is great demand for foreign exchange instruments.

Performance:

- Continuous trading and auction trading

- Real-time price dissemination, order matching and trading

- Open interfaces to back office, risk management and quote vendor systems

- Fully integrated with Patsystems’ architecture

- A fully integrated front-to-back solution for matching, clearing, risk management and front-end trading

- Runs on Windows NT/2000/XP

- Easy and cost effective to support

- Handles hundreds of orders per second, and can scale to thousands of orders

J-Clear allows a wide variety of functional requirements to be fulfilled without the need for constant code updates.The J-Clear processing module fulfils the following exchange requirements:

- Enables trade registration and multi-level clearing and settlement

- Harmonises the exchange clearing framework with the existing regulatory requirements

- Customises clearing and settlement processes to meet member needs without code changes

- Enables day-to-day administration functions:

- Member account management

- Offset contract calculation

- Collateral management

- Contract management

- Margin management

- Fee management

- Gross/net position management